Financial Debt Buying Real Estate in Upstate New York: Opportunities and Considerations

Debt investing in real estate has obtained traction as a strategic, typically less unstable choice in realty investment. For investors eyeing Upstate New york city, financial debt investing supplies a one-of-a-kind means to enter the realty market without the functional duties related to straight property ownership. This guide explores financial obligation investing in Upstate New york city, outlining vital methods, advantages, and considerations for making the most of returns in this area's increasing real estate market.

What is Financial Obligation Purchasing Property?

In real estate debt investing, capitalists provide finances to property programmers or homeowner rather than purchasing the residential properties themselves. This investment design allows financiers to make rate of interest income, with the residential or commercial property as collateral in case of default. Debt investing can be structured with numerous types, such as:

Direct Financings - Financiers lending funds straight to home programmers or property managers.

Real Estate Investment Company (REITs) - Some REITs concentrate solely on financial obligation investments, merging capital to invest in home mortgages and debt-related items.

Property Crowdfunding - Online platforms that permit financiers to add smaller quantities toward a larger loan, offering access to a varied realty financial obligation portfolio.

Why Pick Upstate New York City for Debt Realty Investing?

Upstate New York offers several benefits for real estate debt investors, driven by its mix of metropolitan revitalization and rural need. Key factors that make this region eye-catching for debt capitalists consist of:

Expanding Real Estate Market

Cities like Buffalo, Rochester, Syracuse, and Saratoga Springs have seen development in real estate need. The increased passion in both household and commercial real estate, usually driven by a change toward country and small-city living, develops opportunities for stable financial obligation financial investments.

Varied Residential Or Commercial Property Kinds

Upstate New York provides a range of realty types, from property homes to multi-family buildings and business structures. The variety permits capitalists to pick residential or commercial properties with varying danger levels, aligning with different investment objectives and timelines.

Secure Demand with Less Volatility

Compared to New York City, the Upstate market often tends to be more secure and much less impacted by fast cost variations. This security makes debt financial investments in Upstate New York a strong choice for financiers seeking lower-risk returns.

Economical Entry Factors

Building values in Upstate New York are usually less than those in the city, enabling investors to join the property financial obligation market with relatively smaller sized capital outlays, making it suitable for both beginner and experienced capitalists.

Benefits of Debt Purchasing Upstate New York City Real Estate

Easy Earnings Generation

Financial debt investing in realty can be an ideal means to generate regular passive revenue without the hands-on administration called for in direct building possession. Financiers obtain routine passion payments, supplying predictable revenue streams.

Collateralized Safety

In a debt investment, the building functions as collateral. In case of a default, financial obligation capitalists may have the chance to confiscate on the home, including an added layer of security to their financial investments.

Much Shorter Investment Horizons

Compared to equity financial investments in real estate, financial obligation investments commonly have much shorter durations, usually varying from one to 5 years. This flexibility attract capitalists seeking returns in a shorter period while maintaining an alternative to reinvest or exit.

Potentially Reduced Risk

Debt capitalists typically sit higher on the funding pile than equity capitalists, implying they are paid off initially if the borrower defaults. This reduced danger profile, integrated with regular income, makes financial debt investing attractive to risk-averse financiers.

Trick Methods for Effective Debt Buying Upstate New York City

Review Building Place and Market Trends

Assessing building areas within Upstate New york city's varied landscape is crucial. Financial debt financial investments in high-demand locations, such as residential neighborhoods near significant companies or increasing commercial centers, are normally safer wagers with https://sites.google.com/view/real-estate-develop-investment/ a reduced risk of debtor default.

Companion with Respectable Customers

Vetting borrowers is critical in debt investing. Search for consumers with a solid track record in property advancement or property management in Upstate New york city. Experienced debtors with proven tasks decrease default threat and add to constant returns.

Pick a Mix of Residential and Commercial Financial Debt

To branch out danger, consider financial obligation investments in both household and industrial residential or commercial properties. The property market in Upstate New York is boosted by consistent housing demand, while business residential properties in revitalized city areas provide possibilities for greater returns.

Leverage Property Debt Operatings Systems

Platforms like PeerStreet and Fundrise enable investors to take part in property financial obligation with smaller sized contributions. Some systems concentrate specifically on Upstate New york city residential or commercial properties, making it possible for a local investment technique. These systems simplify the procedure of recognizing debt chances with pre-vetted consumers, due diligence, and paperwork.

Potential Challenges in the red Buying Upstate New York

Danger of Default

Similar to any kind of funding, financial debt investing carries a risk of debtor default. Meticulously assessing the customer's credit reliability, the building's location, and the car loan terms can assist minimize this threat.

Liquidity Constraints

Real estate debt investments usually secure funding for a set period. Unlike supplies or bonds, financial debt investments can not constantly be rapidly sold off. Financiers must be prepared for these funds to be unavailable up until the finance term finishes or a second market sale comes to be possible.

Interest Rate Level Of Sensitivity

Realty financial obligation returns are affected by prevailing rate of interest. Increasing rate of interest can impact borrowers' ability to repay, specifically if they rely upon variable price financings. Analyzing just how possible rate changes might influence a certain investment is important.

Due Diligence Needs

Property financial obligation investing requires comprehensive due diligence to recognize feasible opportunities. Capitalists need to analyze property worths, rental need, and customer qualifications to reduce risk and make sure that the financial investment aligns with personal monetary objectives.

Exactly How to Get Going with Financial Debt Property Investing in Upstate New York

Research Study Market Trends

Begin by exploring realty patterns in Upstate New york city's noticeable cities and towns, consisting of Buffalo, Rochester, and Albany. Comprehending local market fads assists in identifying potential growth areas and emerging investment possibilities.

Get In Touch With Regional Real Estate Financial Investment Groups

Real estate investment teams and clubs in Upstate New York can be beneficial resources for networking, market insights, and referrals on trustworthy financial debt investment choices. These groups usually offer accessibility to exclusive deals and info on high-potential projects.

Take Into Consideration REITs with Regional Emphasis

Some REITs and realty funds concentrate particularly on financial obligation financial investments in Upstate New york city. These cars allow capitalists to benefit from financial obligation financial investments while gaining geographic diversification and specialist monitoring.

Work with Property Financial Investment Advisors

For customized support, take into consideration working with a financial consultant or investment expert that concentrates on real estate. An advisor with regional knowledge can aid determine quality financial debt financial investment chances that line up with your threat resistance and economic objectives.

Last Ideas on Financial Debt Buying Upstate New York City Realty

Financial obligation investing in realty uses a special blend of safety and security and income generation, making it a wonderful selection for those aiming to expand their financial investment portfolios. Upstate New York, with its steady demand, diverse residential or commercial property options, and revitalized cities, provides an ideal background for financial obligation investments that can yield consistent returns.

By concentrating on due persistance, understanding local market patterns, and choosing trustworthy consumers, financiers can make enlightened choices that optimize their returns in this region's thriving property market. For capitalists looking for a fairly low-risk method to participate in Upstate New york city's development without directly handling properties, debt investing is an exceptional course ahead.

Alana "Honey Boo Boo" Thompson Then & Now!

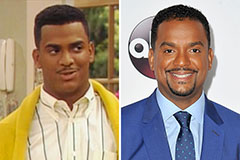

Alana "Honey Boo Boo" Thompson Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!